A New Design (1) (66)

A New Design (1) (68)

A New Design (1) (66)

A New Design (1) (68)

Full 1

Full 1

Full 1

Full 1

Full 1

Full 1

About Us

Sai Satya Vrat Puja

Monthly Sai Vrat Puja will be performed montly once. Please signup using signup sheet at Temple Premise.

Join Sai Seva Volunteers Team

Volunteers for: Sai Baba Arthi, Temple Operations, Prasad Cook / Distribution

and Sandwich Seva

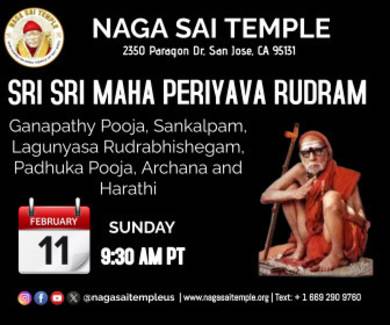

Naga Sai Baba Paduka Puja

Temple will organize Naga Sai Baba Paduka Puja at Naga Sai Temple Devotees Home.

Priest will perform Puja.

Powerful puja helps to remove all obstacles from your home and Baba Blessings

Sandwich Seva

Join our Monthly Sandwich Seva Volunteers Team

Donate for Sandwich Seva to provide food to Homeless Shelters in Bay Area